“I have not failed. I’ve just found 10,000 ways that won’t work.” – Thomas A. Edison

“It’s failure that gives you the proper perspective on success.” – Ellen DeGeneres

“Success is stumbling from failure to failure with no loss of enthusiasm.” – Winston Churchill

“Discouragement and failure are two of the surest stepping stones to success.” – Dale Carnegie

The Puget Sound Real Estate Market

Puget Sound Real Estate: Failure, and the Inflation Forecasts (sounds like a really nerdy band name Haha)

Honestly, could there be a better day to have an Inflation Forecast conversation than on the International Day of Failure? Every economist I know, including myself, is the poster child for failure when it comes to predicting where inflation and the market are headed. In fact, I saw this on Reddit…I couldn’t help myself

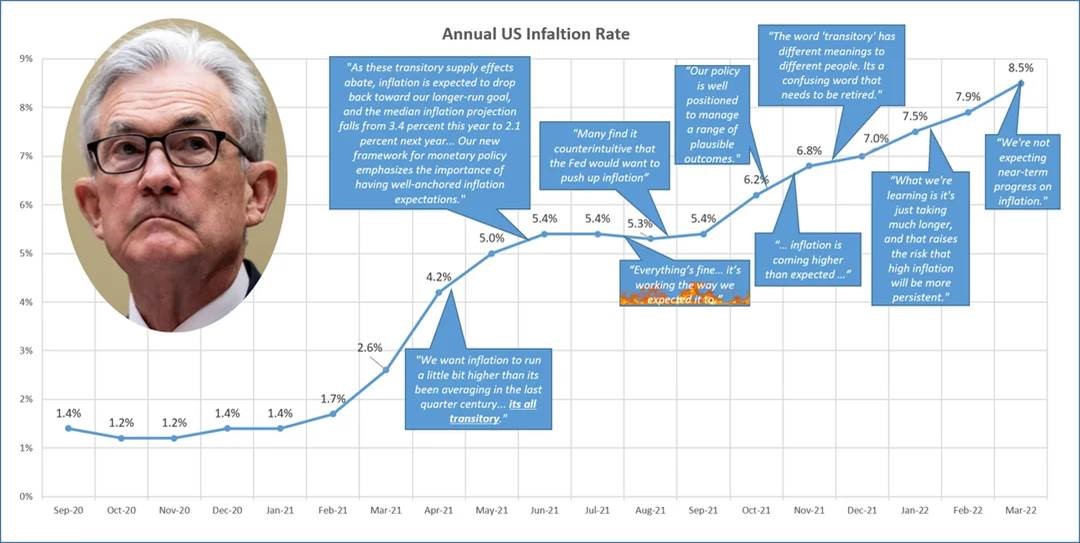

At first inflation was transitory and we didn’t have to worry about it. Then it was “oh shoot, we need to worry about it, but only until the fourth quarter of 2022 or beginning of 2023.” And now “IT’S GONNA BE HERE FOREVER!!! .” So before diving into my thoughts on things, it should be noted that you might wanna take ANYTHING you hear about inflation with a grain of salt. All that said, we’re actually going to start at the end because this is a huge conversation. So for all you TLDRers out there, this is for you.

Take it Home

There are a lot of arguments for why inflation could rise or fall moving forward. At the end of the day, it could be here for a while, or it might not. I tend to think that with Covid Savings now nearly exhausted, high prices at the pump disenchanting spending elsewhere, student loan payments kicking back in, $1 trillion in consumer credit card debt (at today’s really high interest rates), declining Job Openings Numbers, and the highest number of Job Cuts since 2009 (excluding the beginning of COVID) – that inflation will move sideways until the headline employment numbers start falling, at which point, inflation will start falling. So when will employment numbers start falling? Well, probably not for the next month or two as Amazon ALONE has plans to hire 250,000 employees for the holiday season. Add in UPS, FedEx, Retailers…yeah, employment numbers will probably good for at least another 1 or 2 reports. Once we’re through this year’s holiday season though, it’s anyone’s guess. So what’s the forecast on inflation, and therefore mortgage interest rates? My forecast is that it’ll be here for at least another couple months, and that we’ll just have to wait and see how much longer an economy built on a sub 1% Fed Funds Rate, and a housing market built on an average interest rate of 3.74% from 2011 to 2021 (per Freddie Mac) can sustain today’s higher rate environment.

If there’s one thing I’ve learned from all my miscalculations over these past couple years, it’s that I’m probably not going to be wrong in that rates will eventually come down, I just don’t know when they’ll come down. So for now, we keep trucking along with high mortgage interest rates rooted in elevated inflation.

Now From the Beginning…

Shonna Peterson over there at the Warmack [Real Estate] Group asked my thoughts on an article regarding why inflation is going to be here for a really long time. Inflation is important to follow, because it directs where mortgage interest rates are headed. Anyway, the premise of the article is that due to “Two wars unfolding, labor strikes everywhere, government spending at extreme levels, ongoing supply constraints in natural resources, US strategic petroleum reserves at their lowest point in 40 years, and a severe shortage in shelter supply”, the stage is set for inflation to be here for a really long time. To be fair, that’s a perfectly sound hypothesis! …and they may be right!

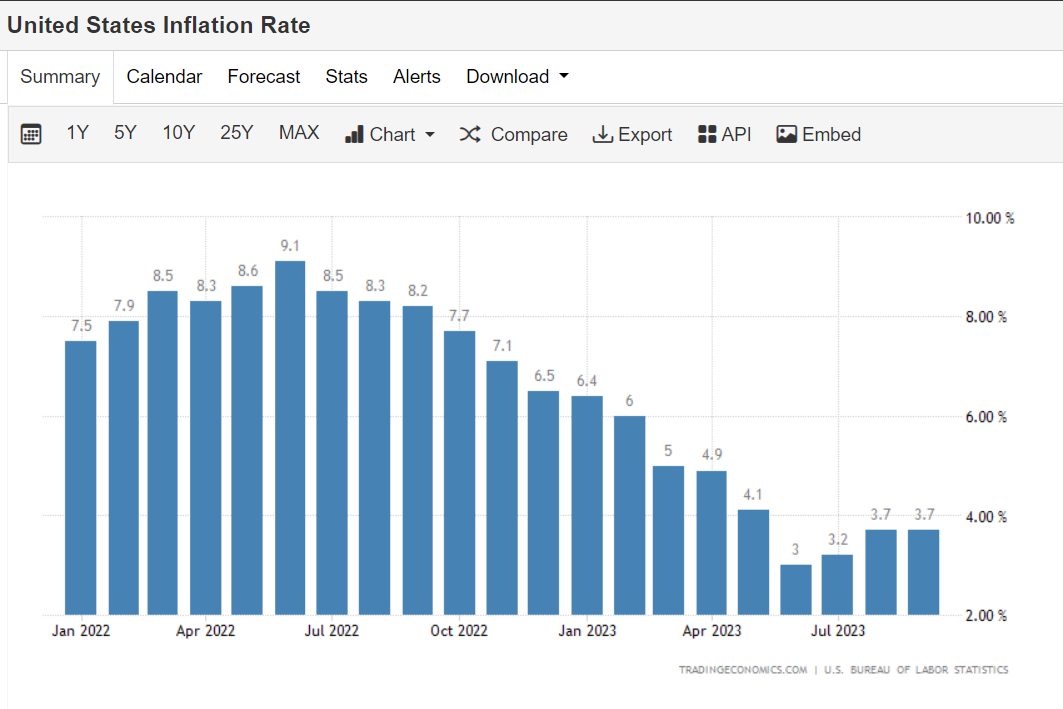

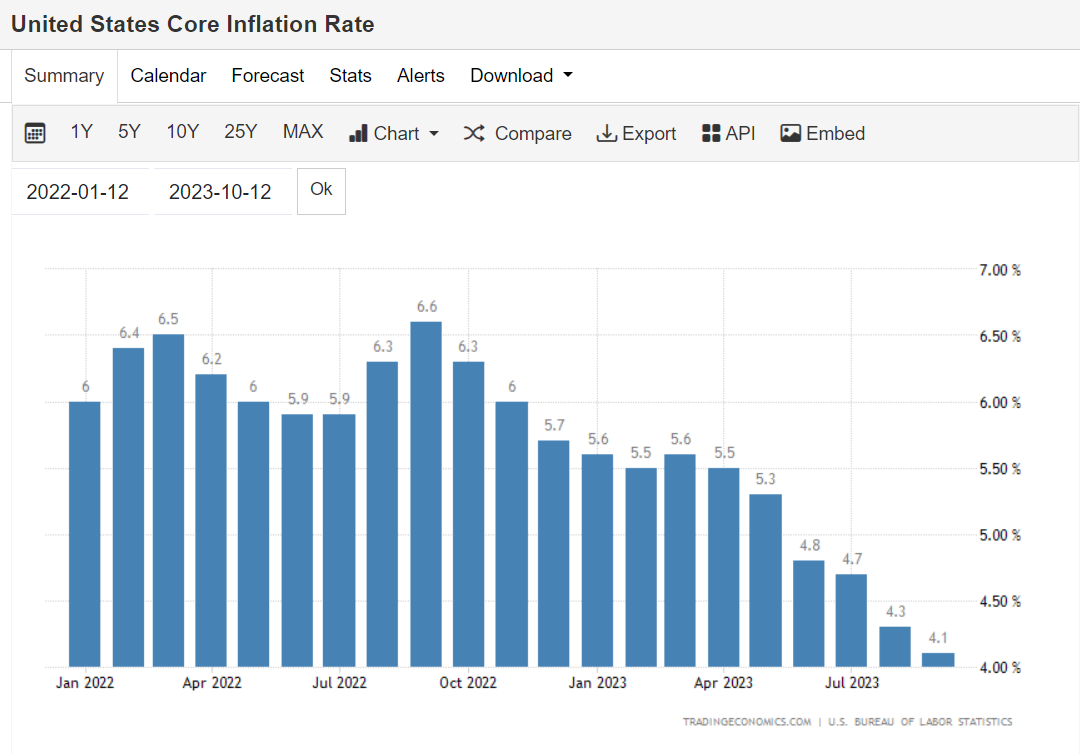

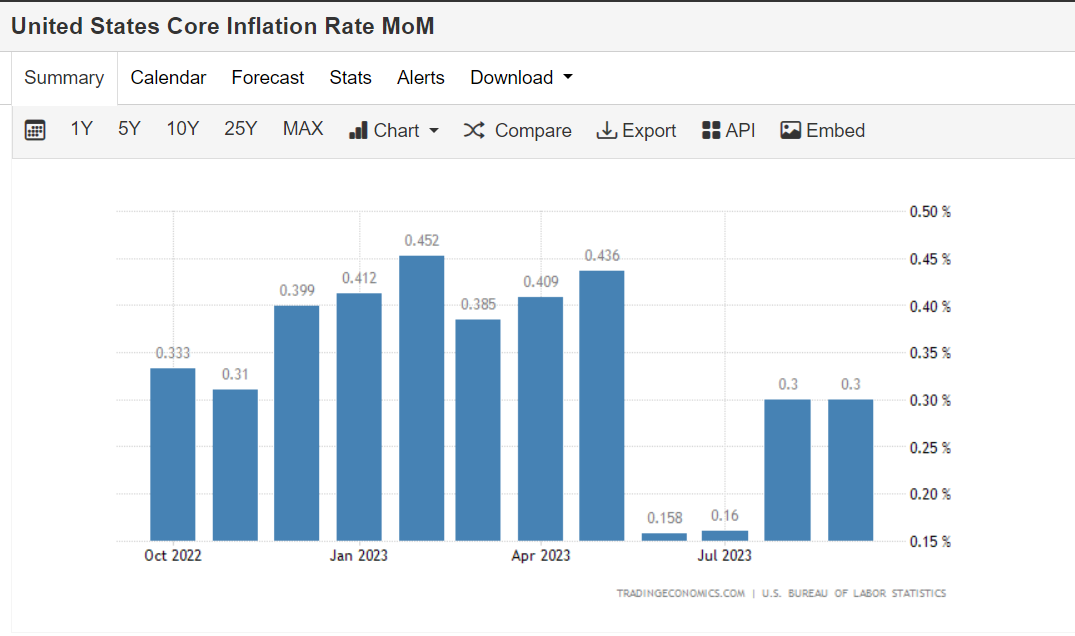

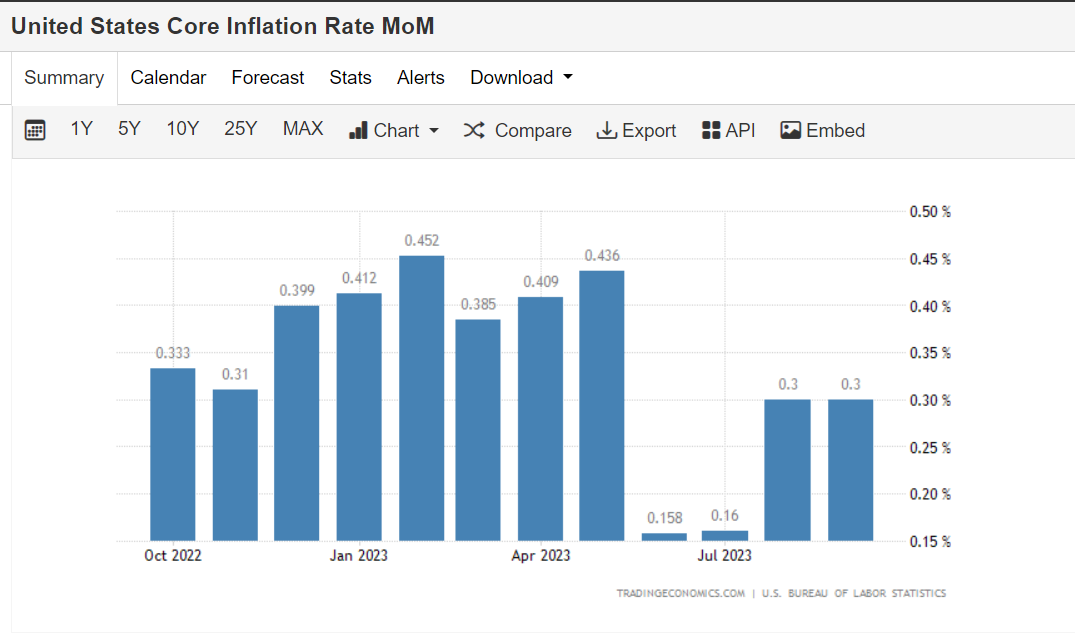

But to argue where inflation might be headed, we should first look at where we’re at now. The Consumer Price Index came out yesterday (Thursday) showing steady headline inflation at 3.7% year over year, and a decrease in Core Inflation to 4.1% year over year. Stepping back, that’s great progress from the 9.1% headline rate and 6.6% core rate from about a year ago (see charts 1 and 2 below); but it’s where we’re headed from here that has everyone in a tizzy. Will inflation keep falling? Or will it rise?

To me, I don’t know why it has to do either of those. I have a feeling it’s going to stay about the same for a while – mostly because the month over month replacement numbers from 12 months ago (between .3 and .4% month over month inflation growth) are about the same as what we seeing now (.3% month over month inflation for the last two months – see Chart 3 below). So here we are, on an inflation shelf with Bulls and Bears making their cases for why they’re going to be right as we move forward.

I’ve said this before with regards to the Puget Sound Housing Market, but it applies here as well: To know where we’re going, we have to know where we’ve been (and why). Ok, you ready for this. This is big. The single biggest reason inflation is still here and rates are still high is because everyone underestimated how hard it would be and how long it would take to pull out $2.1Trillion from the US Economy. Check this out from Elliot Eisenberg:

During the Covid Pandemic, Americans saved an additional $2.1 trillion above and beyond normal savings because of stimulus checks, an inability to travel, and so on.

Since August 2021, $1.9 trillion of that amount has been spent, suggesting there remains just $200 billion left.

At a drawdown rate of $100 billion per month (the rate that has prevailed since mid-2022), the excess will be fully exhausted during 23Q3.

Note that he posted this in August of 2023… It’s October, so based on this, American’s should be at about the end of their savings accounts right now.

To address the argument for why inflation will be higher for longer as mentioned in the article Shonna asked my thoughts on above. Here they are:

- The Fed doesn’t concern themselves with oil and food prices that much, because those trade on a world-market and their policy has no bearing over what OPEC+ will do, for example. The Fed DOES, however, care about the Core Inflation Rate (which excludes food and energy prices). Now, eventually higher food or energy prices will work themselves into the Core rate, but in the short run – Let’s just say I’m not all that thrilled to go on an expensive date night after dropping $100 to fill up my little Ford Edge. Thus, somewhat ironically, higher oil prices put downward pressure on the inflation metrics that the Fed cares most about.

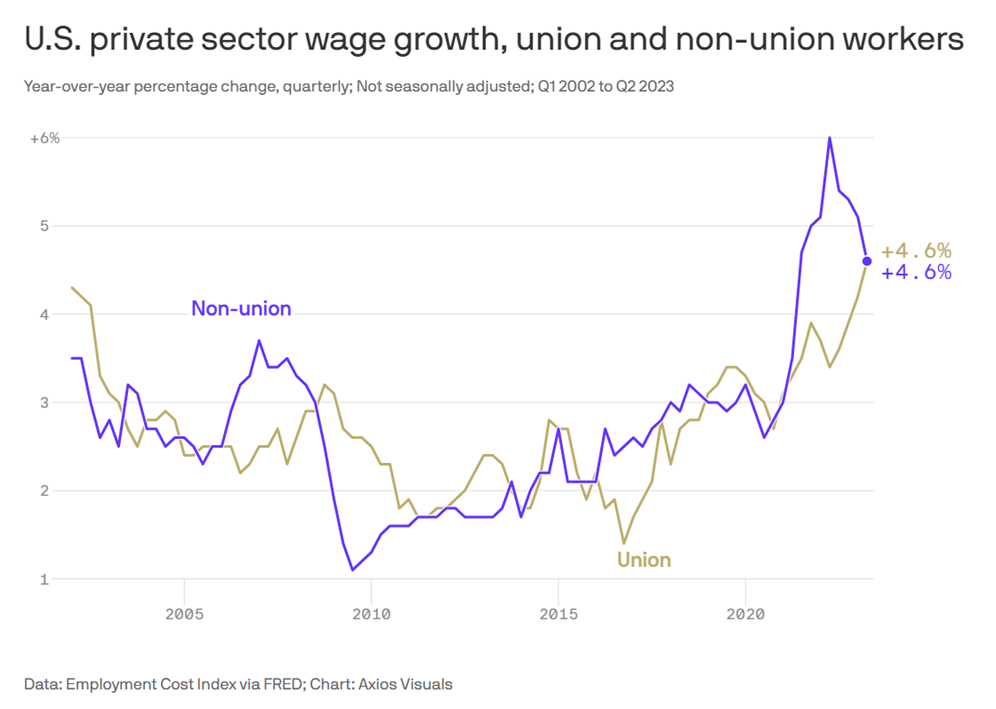

- It’s highly debatable whether or not strikes cause inflation. The reality is NonUnion Workers are seeing the exact same wage growth as Union Workers; and overall, NonUnion and Union workers make about the same (see Chart 4 below, or read this article by Axios)

- For all of history there have been ongoing supply constraints in natural resources, including during times of low inflation. And the same is true for Government spending…our government’s been spending a lot of money for quite a while now, including during times of next to zero inflation. So I don’t know how sound these arguments actually are in this context.

- And lastly, shelter. Shelter is calculated in two ways:

-

- Rent – like renting a 2 bedroom apartment – they just look at how much it cost to rent a 2 bedroom apartment. Pretty straightforward here.

- But for homeowners, they calculate shelter as Owners Equivalent Rent…not how much their house cost, or how much their mortgage payment is…it’s how much would a median homeowner have to pay in rent for an equivalent dwelling. Make sense? So higher housing prices and/or mortgage interest rates don’t directly or immediately translate into the shelter calculation.

- So my counter to this argument for why low shelter supply will equal higher rents and therefore inflation, is simply that even if we have low supply, landlords cannot aggressively increase rents if unemployment rises…

Chart 1

Take it Home – Scroll to the Top

Chart 2

Chart 2

Chart 3

Chart 3

Chart 4

Kind of an aggressive quote on failure, but a strong candidate for Poster of the Month at the Fed.

Interest Rates

Per Mortgage News Daily’s Mortgage Rate Index,

the 30 year mortgage interest rate is at a 7.69% apr today.

Puget Sound Real Estate: Charts and Data

A picture is worth a thousand words…

Days of Single Family Residence Inventory per NWMLS on 10.1.23 (chart below for longer term trends)

- Seattle: 64.09 Days of Inventory (up .47 days since September 15th)

- Bellevue/Redmond/Kirkland: 40.05 Days of Inventory (down 4.32 days since September 15th)

- Everett/Marysville/Lake Stevens: 28.29 Days of Inventory (up 2.8 days since September 15th)

- Tacoma/Lakewood/Federal Way: 58.42 Days of Inventory (down .10 days since September 15th)

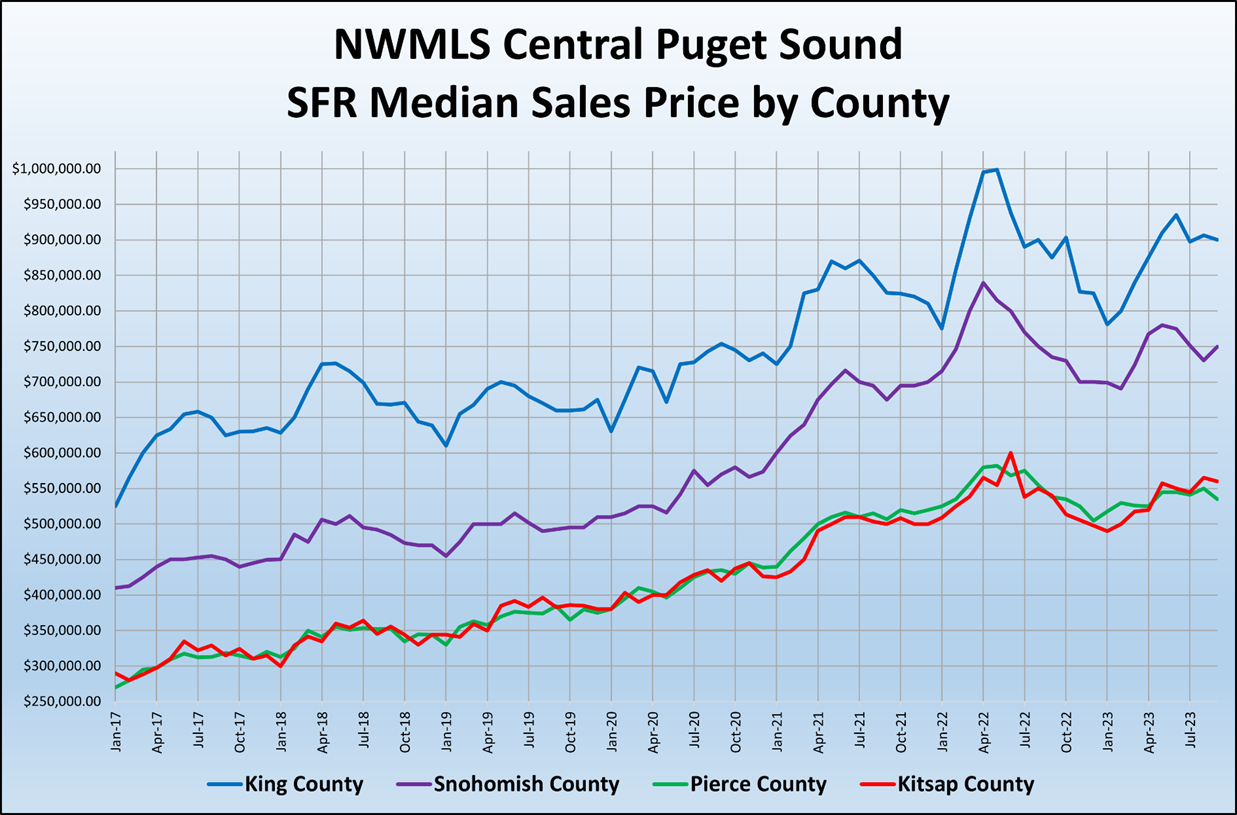

Housing prices remain insanely resilient in the face of record-breaking un-affordability across the Puget Sound

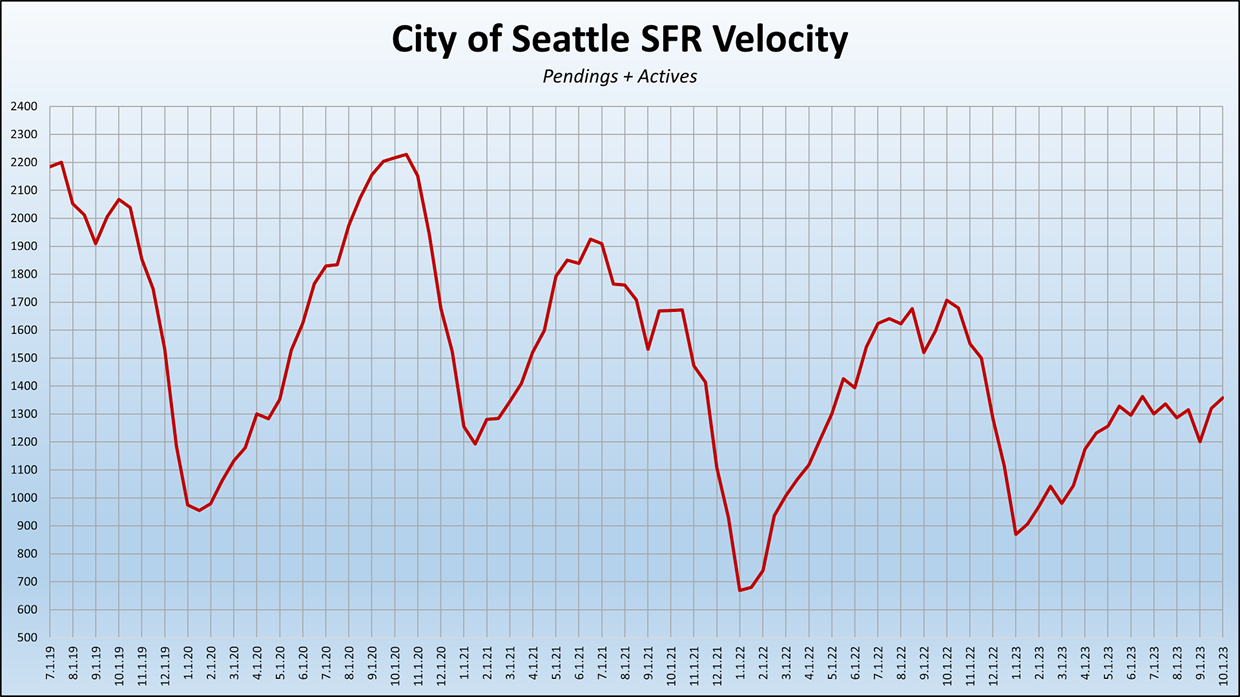

Seattle and the South End are about 2 months of inventory. The Eastside and North End have about 1 month.

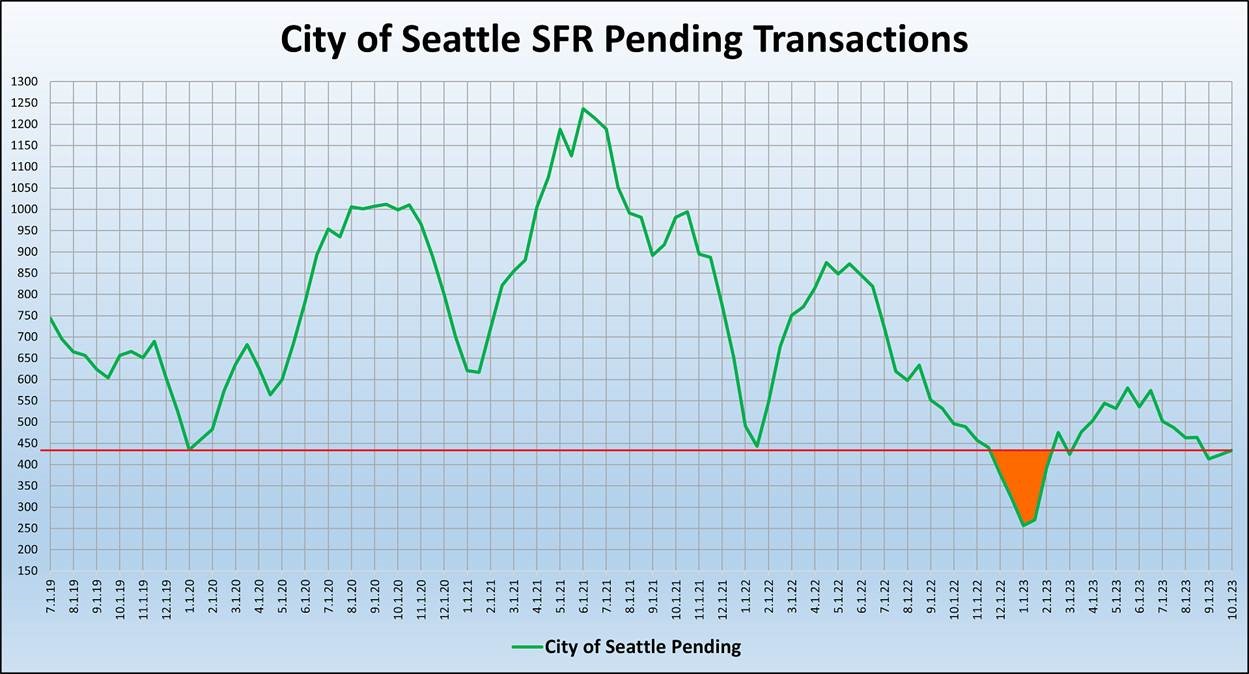

Since 2009, only this past winter had fewer pending transactions to purchase a home than we have now.

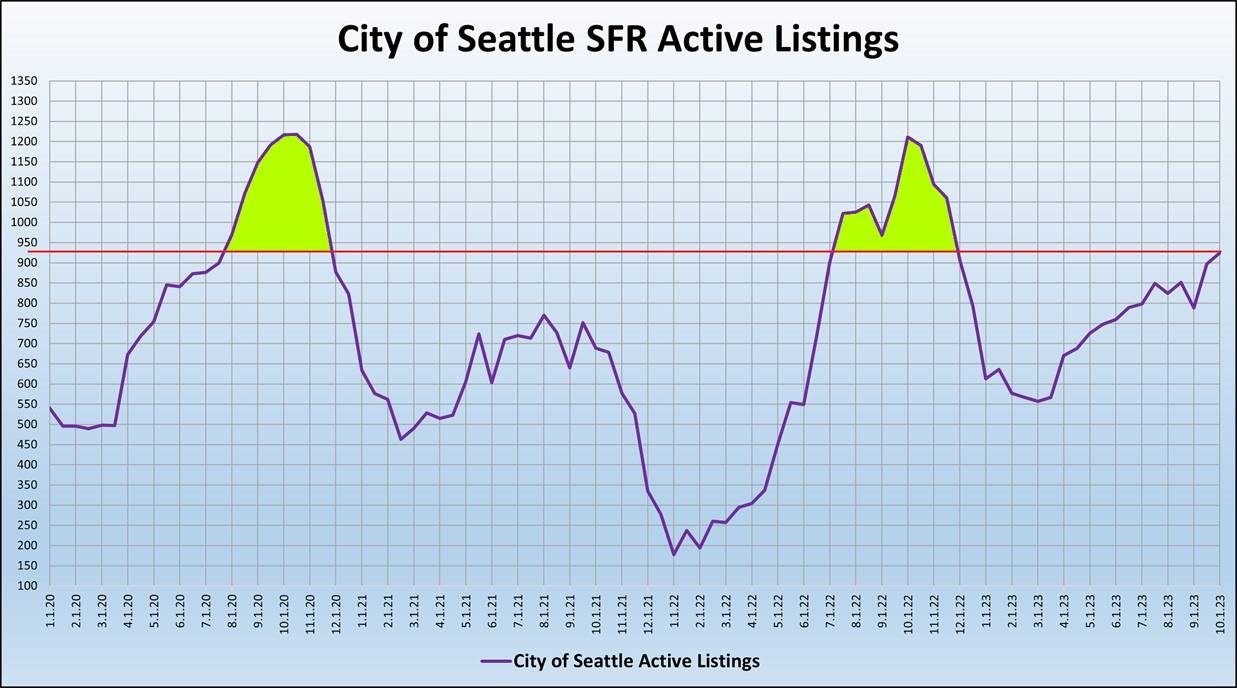

Very few months in the past few years with as many Active Listings in Seattle as we have now.

Ok, that’s all for now. Be an example what failure looks like without quitting, and have the best weekend ever! ß That quote, btw, was all me : )

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link